Come explore the industry with us!

If you’re looking for data-driven insights that reveal top technology solutions your competitors are using, as well as new industries to service, you’re in the right spot!

OMG partnered with Stax, Inc., a global management consulting company, who surveyed more than 1,000 promotional products distributors, apparel decorators, and team dealers to create the industry’s first-ever Technology State of the Union report.

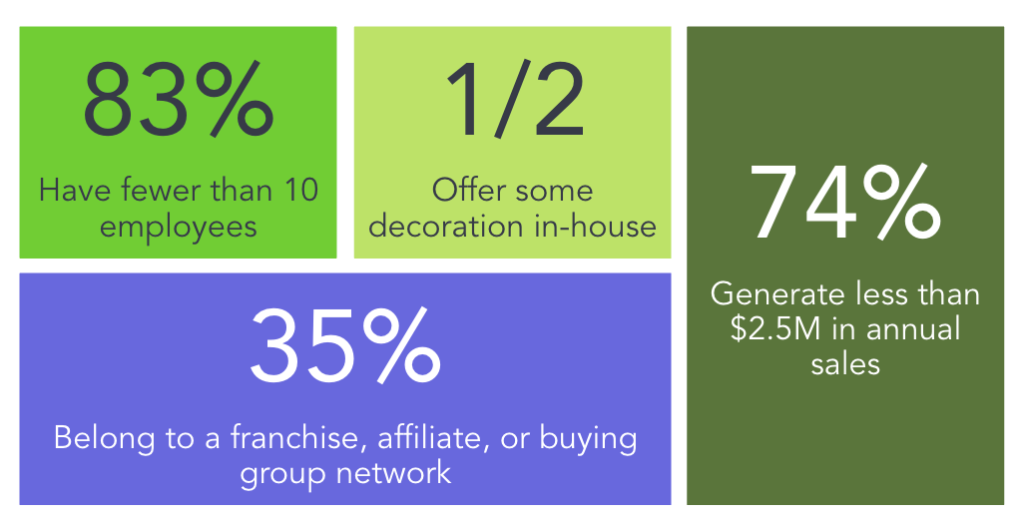

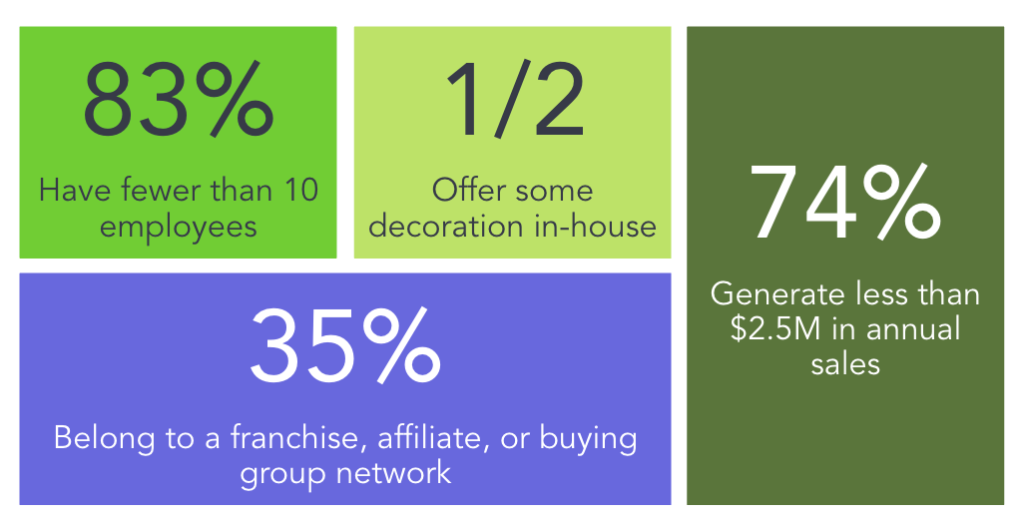

Out of those distributors, decorators, and dealers surveyed:

Although the survey primarily focused on understanding the use of technology within the industry, it was supplemented by in-depth interviews with key industry stakeholders. From those findings, we learned about the top verticals to service, the differences between eCommerce vs. online stores, and popular software solutions.

Here is a rundown of those findings:

Top Verticals to Service

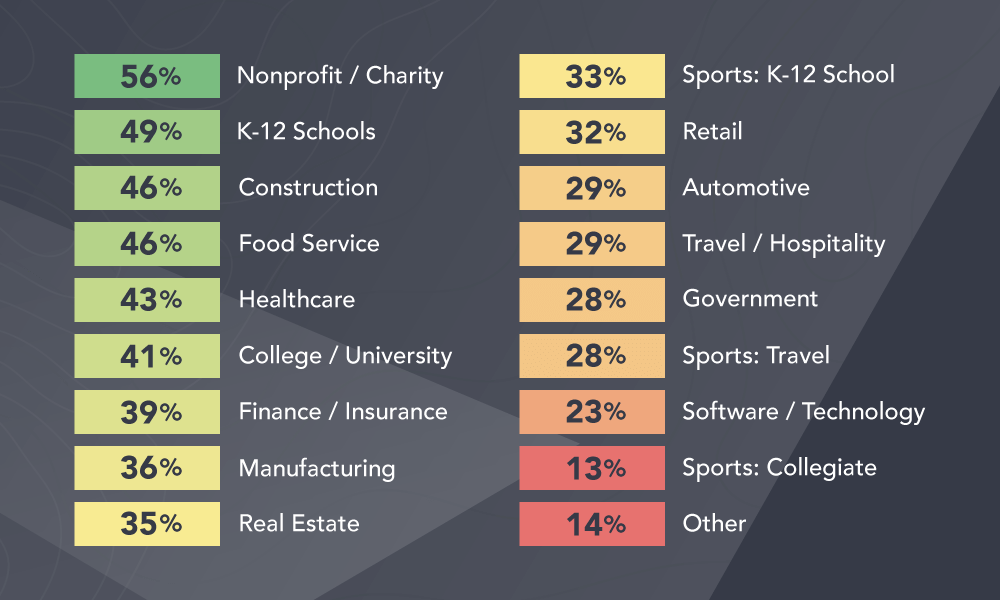

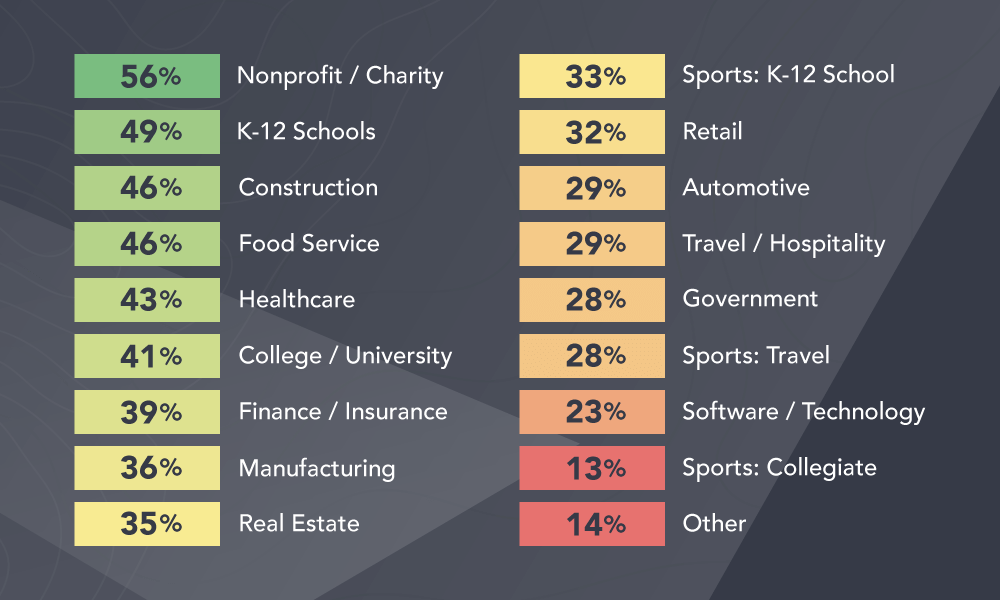

Figuring out which industries to service can be a little tricky, especially if you want to expand into new markets. If you’re curious about the verticals your competitors are serving, here’s a brief breakdown:

- According to those surveyed, down-market respondents largely cater to non-profits and K-12 schools. These are distributors and dealers with revenue of <$2.5 million and decorators with revenue of <$1.5 million, who DON’T belong to a franchise, affiliate, or buying group.

- Up-market respondents cater to healthcare institutions, financial organizations, hospitality, and college & universities. These are larger distributors and dealers with revenue of >$2.5 million and decorators with revenue of >$1.5 million, who DO belong to a franchise, affiliate, or buying group.

For other popular verticals to service, see the graphic below:

Online Sales Channels: eCommerce vs. Online Stores

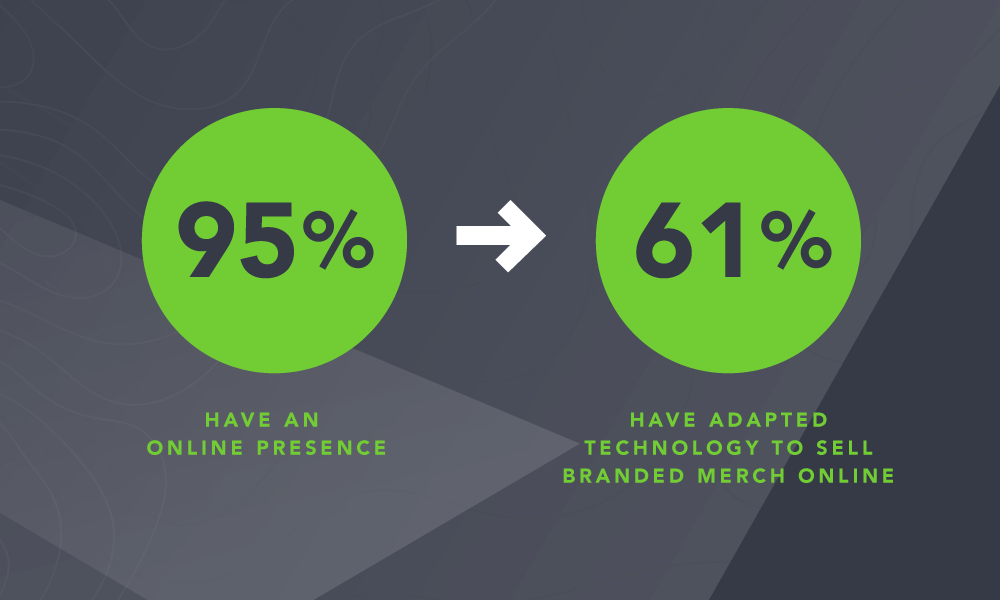

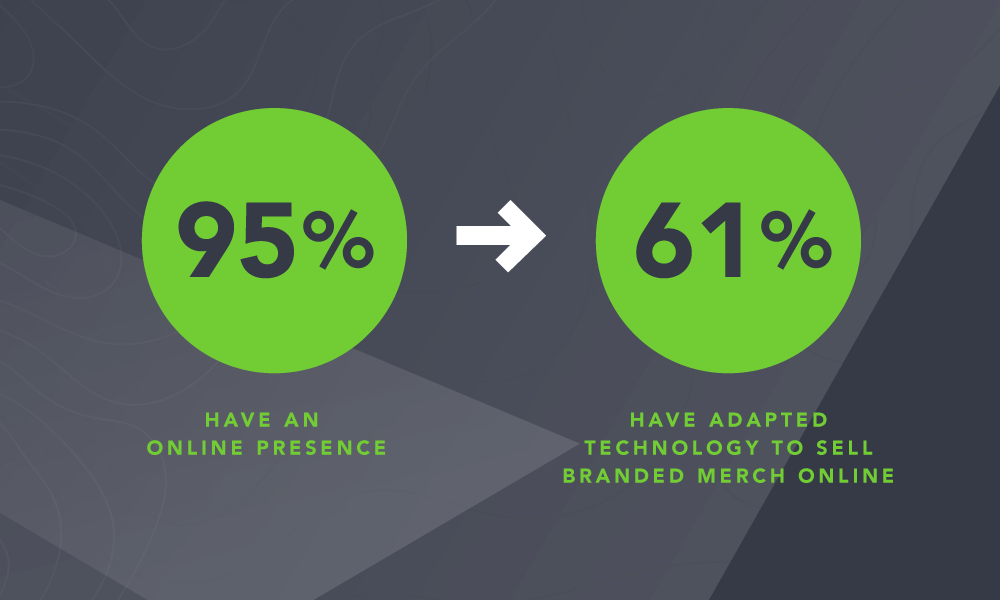

Distributors, decorators, and dealers are more likely to opt for an industry-specific solution for online stores and a non-industry-specific solution for eCommerce functionality, particularly decorators. However, while nearly all (95%) of the survey respondents had a web presence, only 61% had adopted the technology needed to sell customized promotional goods online.

There is significant overlap between the users of online stores and eCommerce-enabled websites.

But, what’s the difference between the two?

One of the biggest differences is online stores offer a more personalized experience tailored for specific groups, compared to eCommerce websites, which provide a generic shopping experience with agnostic products.

According to the Technology State of the Union report, distributors, decorators, and dealers who embrace online sales channels, using both eCommerce and online stores, generate nearly 30% of sales through those channels. To sum it up, online stores generate 17% of sales, and eCommerce solutions generate 13% of sales (refer to page 16 of the report for more details).

Technology Adoption: Popular Software Solutions

Okay, let’s talk technology, shall we?

The Technology State of the Union report states there are 6 solutions that the top industry players use:

Out of those 6 options, product search and accounting software have the highest usage among distributors, decorators, and dealers. Larger companies within the industry that are part of a franchise, affiliate, or buying group are more inclined to adopt various technology solutions to help with running day-to-day operations (refer to page 19 of the report for more details).

Finally, up-market distributors, decorators, and dealers that have a physical retail space are more likely to invest in more technology platforms – specifically 28% of up-market distributors (revenue of >$2.5 million) who use 5+ stack options from above.

3 Key Takeaways to Remember

[Key takeaway #1] The largest, highest revenue-generating businesses in the industry embrace various technology solutions:

This technology allows businesses to work more efficiently and grow. In terms of scalability, technology allows you to reach more customers and sales with less work and overhead.

[Key takeaway #2] Industry leaders are leveraging online sales channels:

Introducing new channels, like online stores and presentations, makes it easier for your customer to get exactly what they need – with less work on your end. Whether it’s out of preference or necessity, digital is the new default for many organizations and consumers.

[Key takeaway #3] Distributors, decorators, and dealers prefer to use industry-specific solutions for online stores:

Using an industry-specific platform will align directly with your current business processes without you having to change the way you do things in order to use generic technology. Online stores can be a quick way to drive incremental revenue and create new long-term revenue streams.

Whew… we can agree, that was a lot of information to take in, so we’ll keep this short:

If you’re more of a visual learner, watch the webinar recording that breaks down each of these points. Or, if you want to download a copy of the full report, you can do so by clicking here.

Lastly, if you’re looking for even more industry insights, check out these relevant resources:

About OrderMyGear

OrderMyGear (OMG) is an industry-leading sales tool, empowering distributors, decorators, and dealers to create sleek, retail-like online stores for every customer – big or small. Since 2008, OMG has been on a mission to simplify the process of selling branded products and apparel to groups and improve the ordering experience. With easy-to-use tools and unmatched support, the OMG platform powers online stores for over 3,500 clients generating more than $1.5 billion in online sales. Learn more at www.ordermygear.com.

Media Contact: Lauren Seip | lauren.seip@ordermygear.com | 281-756-7915