Have you ever wished you had more time to pay when making a big purchase online? Whether you’re buying a new piece of furniture for your home, splurging on the latest tech product, or planning that dream vacation—having control over when you pay can be the deciding factor in whether or not you make a purchase.

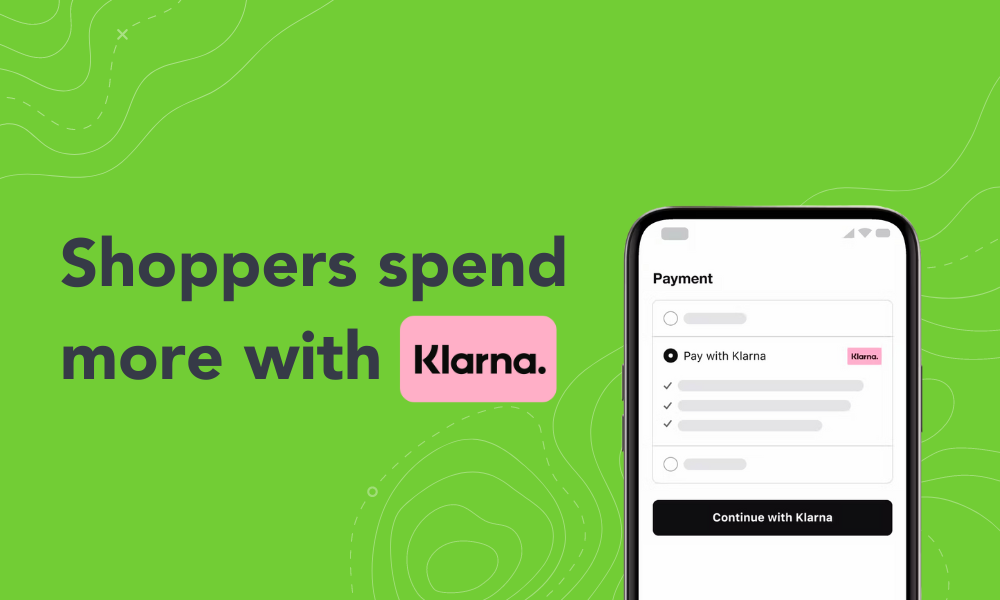

The same goes for consumers shopping on your online stores. Introducing: Klarna (Buy Now, Pay Later).

What is Klarna (Buy Now, Pay Later?)

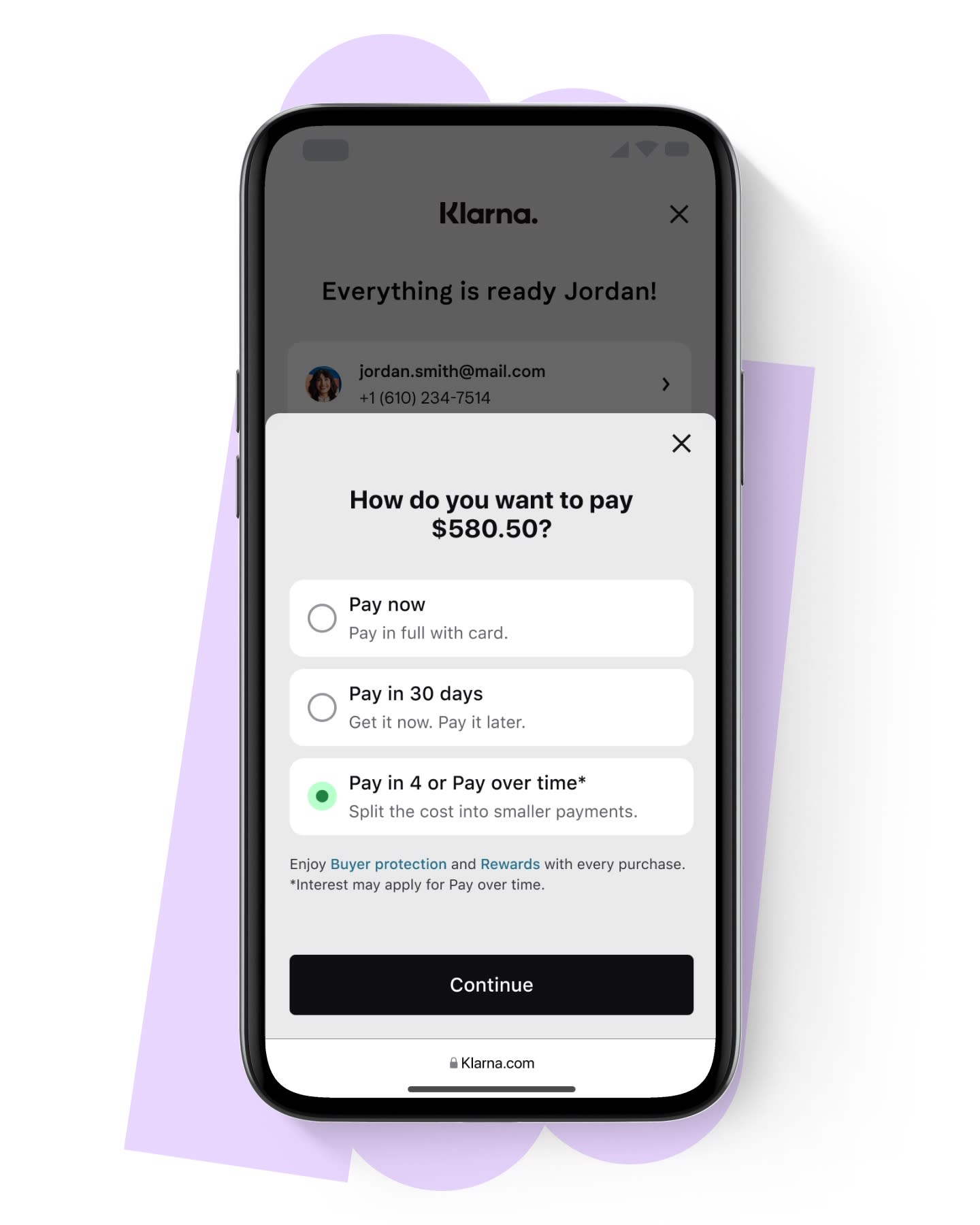

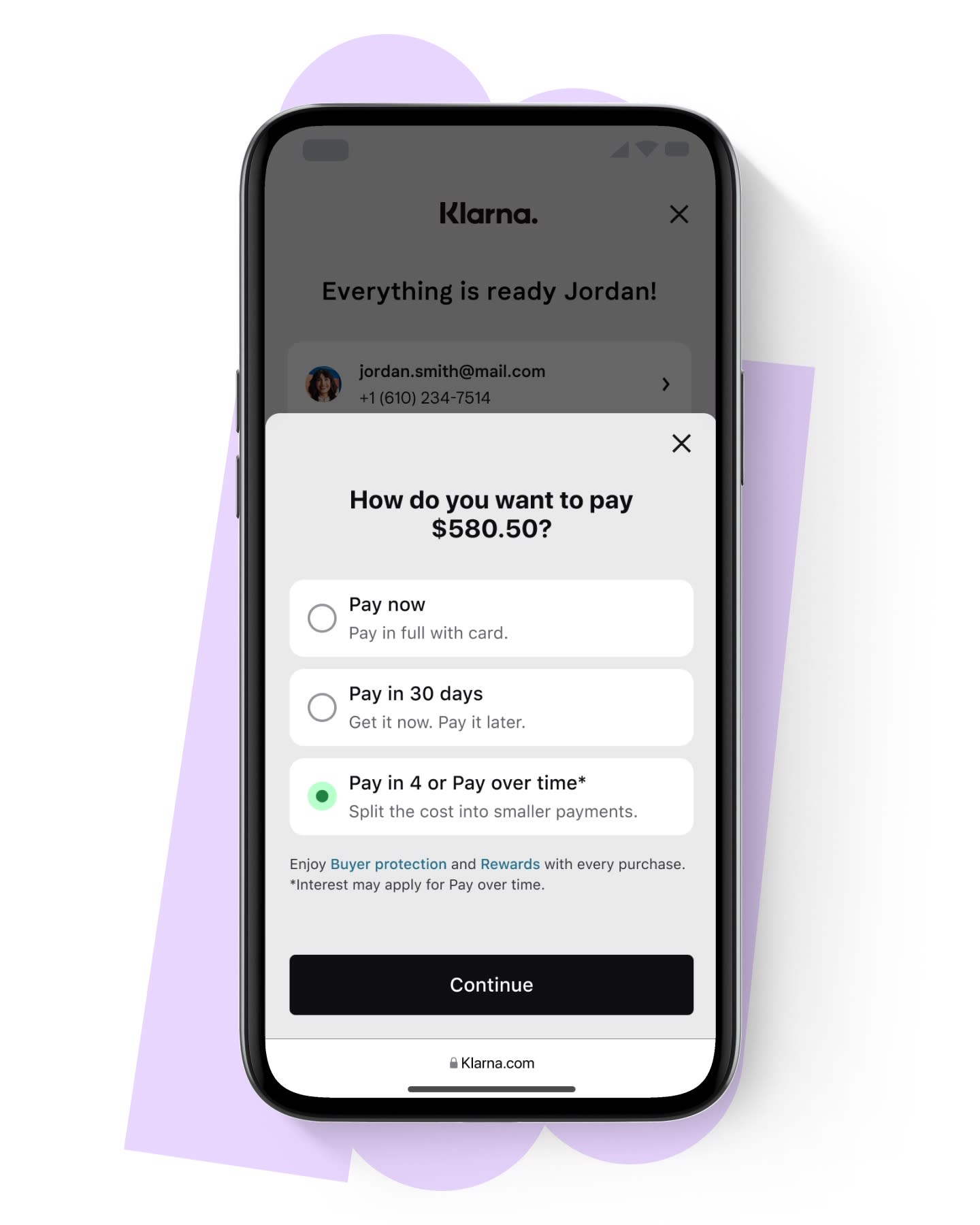

Klarna is a leading Buy Now, Pay Later (BNPL) solution that allows shoppers to split their purchases into smaller, interest-free installments – like ‘Pay in 4’ or ‘Pay in 30 Days.’ This gives shoppers more financial freedom to stay within their budget while still purchasing the products they need, when they need them. BNPL methods have surged in popularity in recent years, thanks to their flexibility and convenience. In fact, BNPL methods are projected to make up 24% share of global ecommerce by 2026.1 And the best part? You get paid in full and upfront like any other regular transaction, while the consumer gets more time to pay. Klarna also handles collecting the payments from the consumer and addressing any fraud or missed payments, so you can focus on growing your business.

Why Use Klarna?

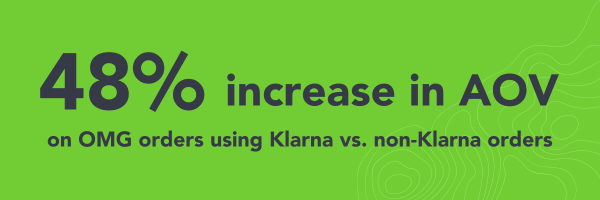

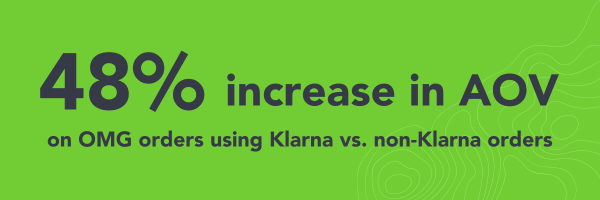

Adding Klarna as a payment option to your online stores can significantly boost the value of your orders. Impressively, orders placed using Klarna on OMG see a 48% increase in Average Order Value (AOV) compared to orders not using Klarna.2

We’ll let that sink in for a moment.

Let’s explore some of the top reasons to offer Klarna on your online stores and why shoppers are buying more, more often, when it’s presented as a payment option at checkout.

- Boost checkout conversion. A $300 cart total might discourage some consumers from checking out, but when they can split that cost into three $100 payments, the transaction can seem less daunting. BNPL methods help motivate shoppers to place an order now, instead of abandoning the purchase altogether.

- Increase average order value. BNPL methods often encourage shoppers to purchase higher-value items, like premium apparel or quality team gear and equipment. It can also motivate shoppers to order more lower-value goods at one time, increasing your average cart total.

- Reach new customers. BNPL methods can help you tap into new market segments by making a purchase easier on the shopper’s budget. These payment methods are especially attractive to younger customers who may not have a credit card or the ability to pay for large purchases in a single payment. Roughly 70% of customers in Klarna’s network are Gen Z or millennials.3

What are common use cases?

Klarna can be offered as a payment option for many types of customers and programs – whether you’re a team dealer, promotional product distributor, or apparel decorator. Here are some of the most popular use cases where Klarna is being used on our online stores today.

- Team Uniforms & Equipment – High-quality team gear can add up quickly, especially for parents with multiple children in sports or players paying for gear themselves. Klarna makes it easy to spread payments out over time so parents and players can purchase required gear for the season, without spending hundreds of dollars at a time.

- Company Swag – Companies commonly offer online stores to their employees to purchase branded merchandise, from high-end headphones to trendy tumblers. Klarna offers an easy way for employees to purchase the premium items they want without breaking the bank.

- Spirit Wear – Spirit wear is frequently purchased by students, like high school students purchasing apparel for the big game or college students stocking up on merch from the university bookstore. Klarna can be a cost-friendly payment option for students and younger consumers to rep their favorite team with gear they love.

- Holidays & Events – Budgeting is top-of-mind for most consumers around the holidays. While it’s common for companies to gift an item to employees at the end of the year, sometimes shoppers want an additional product from the online store that’s not covered by the employer. Klarna can help employees order the gifts they want without the added stress around the holidays.

What are some best practices?

- Create a retail-like experience. Shoppers expect a retail-like experience when shopping on your online stores, similar to the brands and retailers they shop from regularly. Adding popular payment options like Klarna can help reflect the modern experience consumers are used to, and trust buying from, when shopping online.

- Checkout in seconds. While one of Klarna’s top benefits is making expensive orders easier, it’s not always used for splurging or special purchases. Klarna can also be used as a digital wallet option, similar to Apple Pay or Google Pay. Since shoppers are required to set up an account to use Klarna, their information is already populated at checkout which makes completing a purchase quick and convenient.

Start selling, more!

Buy Now, Pay Later methods can help boost your average order value, simplify the checkout process, and even broaden the consumers shopping on your online stores. Don’t just take it from us, try it out for yourself:

- If you’re already using OMG, simply toggle the Klarna button on under the Payment & Info tab of your online store. Klarna must be turned on at the store-level.

- If you’re not using OMG, we’d love to chat with you! Schedule a one-on-one meeting with a member of our team to learn more about online stores to grow your business.

1 Juniper Research – BNPL Report

2 Based on internal OMG data (2024)

3 Based on Klarna data (2024)