In Q2 2025, the branded merchandise industry continued to face some tough economic headwinds—slowing consumer spending, higher interest rates, and uncertainty around potential new tariffs. These factors caused many organizations to tighten their marketing budgets, and buyers became more cautious with non-essential purchases.

But despite the cautious economic climate, there’s good news: online stores for branded merchandise are thriving. Businesses are launching more of them than they did at this time last year, and those stores are generating strong results—helping many promotional product distributors, decorators, and team dealers stay on track with their annual goals.

So, where exactly is this growth happening—and how can you capture it?

The Q2 2025 Online Store Benchmark Report reveals exactly that. It identifies the industries and store types that are performing best, helping businesses that sell branded merchandise like yours identify the smartest areas to target next.

Where to Grow: Industries Fueling the Momentum

While some sectors pulled back, others stepped up—offering big opportunities for businesses that know where to look.

Real Estate

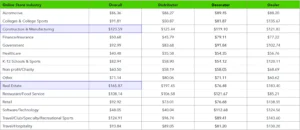

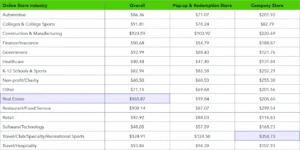

The Real Estate industry topped the list for the highest average order value (AOV) at $165.87 across all store types. This growth is no coincidence. Spring is peak home-buying season, and real estate agents placed more online orders to support increased activity, think branded yard signs, open house materials, welcome gifts, and marketing handouts. These purchases aren’t just practical, they’re high-impact and high-value, which makes this sector an ideal target for promotional product sellers.

Construction & Manufacturing

This industry also saw standout performance, with an overall AOV of $123.59—the third highest across all industries, and up nearly 30% from Q1. This is largely due to seasonal trends. As the weather warms up, construction projects and factory activity ramp up, driving more demand for branded items like uniforms, safety gear, tools, and durable equipment. For suppliers and decorators, this is a great time to engage with these buyers and offer solutions that keep teams outfitted and job-ready.

Store Types Matter: Matching Format to Industry Needs

Understanding which store types perform best in each industry can help you align your sales strategy for even better results.

Real Estate: Short-Term + Long-Term Wins

In Real Estate, Pop-up and Redemption Stores saw a solid AOV of $99.84, proving their value in fast-moving, seasonal moments like the spring buying rush. Brokers and agents use these short-term stores to quickly access branded tools they need to promote listings and impress clients.

Meanwhile, Real Estate’s Company Store AOV hit $206.60, showing a growing investment in long-term, always-open store solutions. These stores help maintain a consistent look and feel for a real estate brand, streamline reordering, and support agents throughout the year.

Construction & Manufacturing: Stronger with Company Stores

For Construction & Manufacturing, Company Stores are leading the way with an AOV of $220.69—more than double that of Pop-up Stores at $103.92. This reflects a need for ongoing access to workwear, safety gear, and job site essentials. Long-term stores make it easy for project managers and procurement teams to place consistent orders across teams, departments, or locations—driving higher value per order and stronger customer loyalty.

Expand Your Reach by Diversifying Your Customer Base

In addition to targeting new industries, many top-performing businesses are winning by diversifying who they sell to.

Distributors are increasingly serving schools and sports teams, offering uniforms and spirit wear that are always in demand.

Team dealers, on the other hand, are breaking into the corporate space, supplying businesses with branded apparel, employee recognition gifts, and event swag.

This shift is smart: by expanding into new customer types, you reduce your reliance on any one market and open the door to more steady, year-round business.

Expand Your Reach by Offering Faster Fulfillment and More Decoration Methods

OMG Print-on-Demand (POD) Stores saw an average of $103 per order in Q2—outpacing non-POD stores, which averaged $70 per order. POD stores sales grew 3.1% year-over-year, driven by rising demand for hands-off, quick turn fulfillment options from companies who sell branded merchandise.

POD offers branded merchandise businesses the chance to serve customers with small-batch orders, and quick turn times by minimizing inventory risks. Customers love POD stores because they offer faster turnaround times and a wider variety of product decoration methods.

Learn more about OMG’s Print–on-Demand stores and see how this decorator was able to say yes to more business and generate $125,000 in sales with print-on-demand.

How OMG Helps You Capture These Opportunities

At OrderMyGear (OMG), we make it easy for you to say yes to more sales with powerful, flexible online stores. Whether you’re a decorator outfitting a construction crew, a distributor supplying signage and gifts to real estate firms, or a team dealer breaking into corporate apparel, OMG helps you unlock more revenue—without adding more complexity.

Ready to say yes to more business, more often? OMG is here to help you scale smarter.

Get the Full Report

Want to see all the data behind these trends—and discover where the next big opportunities are?

Download the Q2 2025 Online Store Benchmark Report to get insights that can help you grow your sales, reach new customers, and stay ahead of the curve.